Trying to think of a way to give your employees a bonus or offer an incentive that isn’t cash? A Lifestyle Spending Account offers an excellent means to not only promote a healthy lifestyle but also allow employees to proactively manage their own well-being.

Lifestyle Spending Account is an innovative, cash-free way for employers to reward employees. The benefit for employers is that, unlike a cash bonus, an LSA expense can be written off as a business expense. It adds some flexibility to already existing benefits plans, and is a pay-as-you-go service that is easy to implement and control. It’s also a great way to promote wellness and a holistic lifestyle for your team members.

This is how it works. You choose the yearly sum (let’s say, $1,000), and your employees choose what they want to put it towards (a gym membership and yearly supply of protein powder). Then, you only pay for the amount they use.

Lifestyle Spending Account Examples:

• Health & Fitness Related (Fitness Equipment, Apparel, Vitamins, Supplements etc.)

• Family & Lifestyle (Green Living, Transportation, Elder Care, Infant Care, Pet Care etc.)

• Technology Related (Computer, Mobile Devices, Electronics)

• Personal (Education, Spa Services, Cosmetic Procedures, Family Leisure)

• Special (Pay all receipts as submitted – no rejections)

These are just a few of the many options available to you, we recommend choosing health and wellness services that reinforce the core values of your business. An effective and comprehensive lifestyle spending account is not only an effective means of attracting top talent, but it is also essential to promoting good health for your existing workforce.

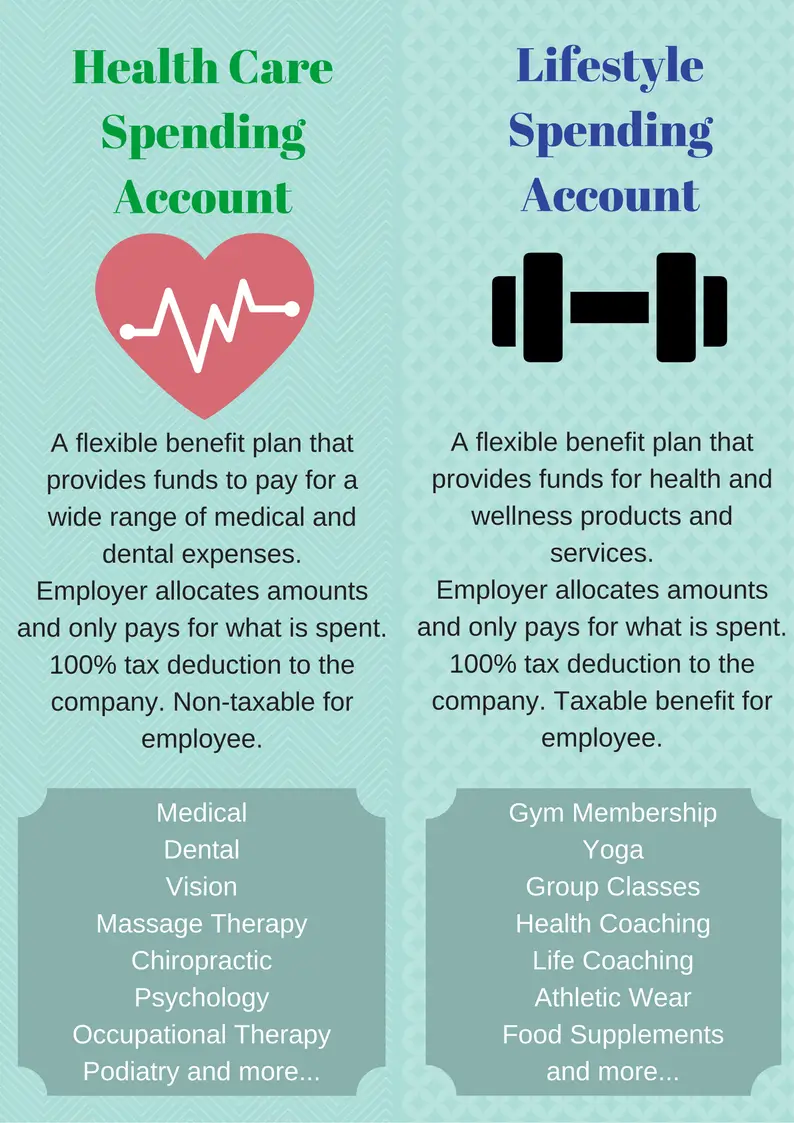

Lifestyle Spending Accounts are similar to Health Care Spending Accounts in that they are both spending accounts, but they are certainly not identical. Unlike an HCSA, the Lifestyle Spending Accounts' services are less about treatment and more about prevention, hence the name “lifestyle.” Below is a more detailed breakdown of differences and similarities between the two.